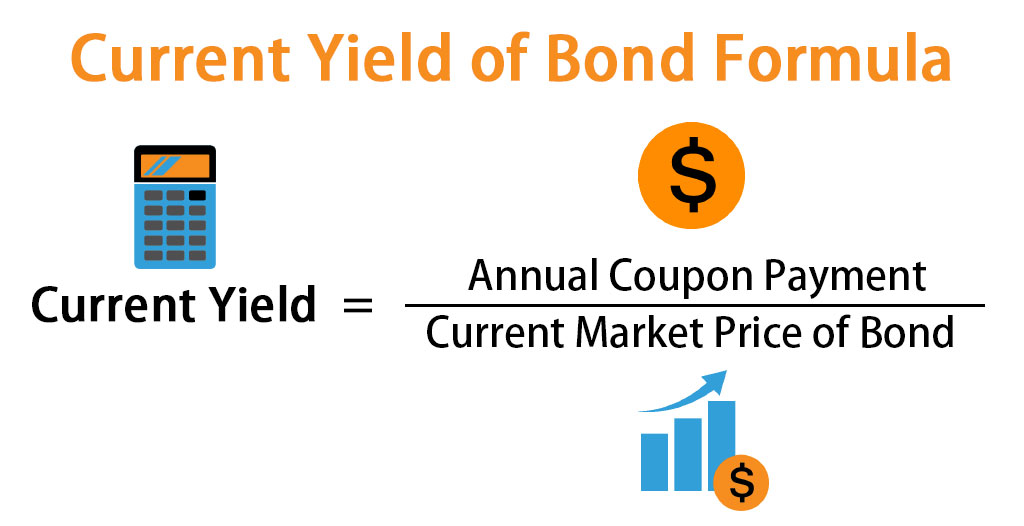

Current yield of bond formula

Current yield is a bonds annual return based on its annual coupon payments and current price as opposed to its original price or face. Current Yield Coupon Payment Market Price of Bond Current Yield Definition Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield.

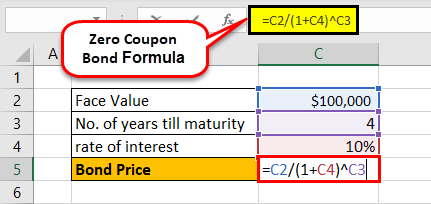

Zero Coupon Bond Value Formula With Calculator

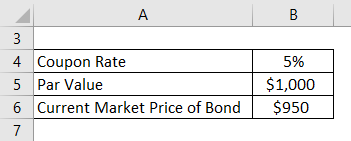

Example An investor is considering the purchase of a bond of 1000 par value and an annual coupon rate of 115 at a current market price of 991.

. The current yield formula is very simple. Use the bond current yield formula. Bond current yield annual coupon bond price.

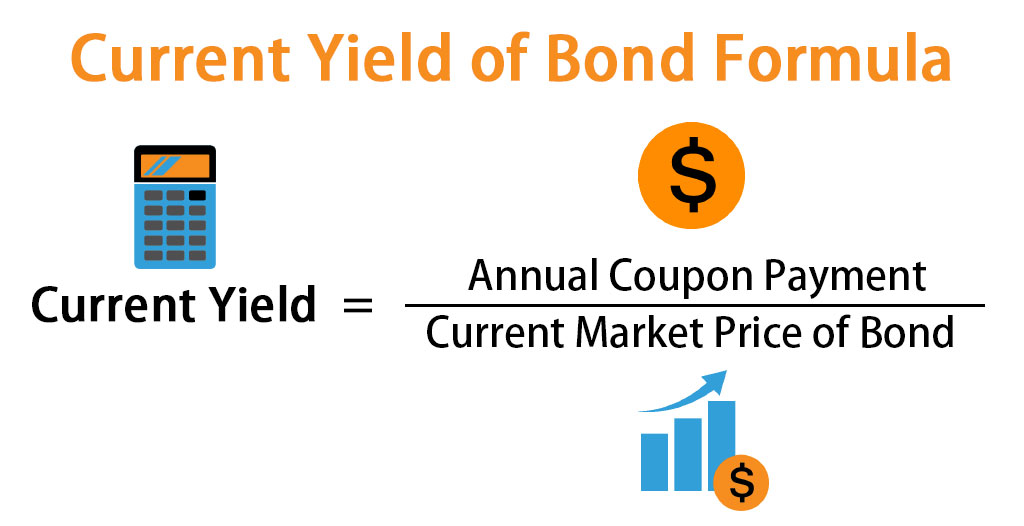

Below you will find descriptions and details for the 1 formula that is used to compute current yield values for bonds. The formula for calculating current yield is. Calculation of bond yield Bond Yield Annual Coupon PaymentBond Price 781600 Bond Yield will be 004875 we have considered in percentages by multiplying with 100s.

The formula for current yield is expressed as expected coupon payment of the bond in the next one year divided by its current market price. Because this formula is based on. The rate of interest which is used to discount the future cash flows is known as the yield to maturity YTM Bond Price i1n C 1rn F 1rn or Bond Price C 1- 1r-nr F.

For example assume an investor buys a bond with 6 coupon rate at a discount of 9000. The formula for current yield is a bonds annual. This is called the coupon rate.

Last but not least we can find the final result using the bond current yield formula below. Formula The formula for the current yield is Annual Coupon Payment Current Bond Price Let us understand the calculation with the help of an example. Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon payment by the bonds current market value.

Current yield simple yield of a bond. The simplest way to calculate a bond yield is to divide its coupon payment by the face value of the bond. How to calculate the current yield formula.

Current yield annual coupon interest bond price The annual coupon interest is the total payment received by the bond annually and. 2 text Coupon Ratefrac text. Current Yield Formula To determine the current yield you need to divide the amount of the coupon rate by the price the bond is currently selling for.

In this video we are going to discuss about Current Yield its formula and with examples and many more𝐂𝐮𝐫𝐫𝐞𝐧𝐭 𝐘𝐢𝐞𝐥𝐝 𝐅𝐨𝐫𝐦𝐮𝐥𝐚. The investor earns interest income of 60. Where I is the annual interest.

For our first returns metric well calculate the current yield by multiplying the coupon rate by the par value of the bond 100 which is then divided by the current bond quote. Mathematically it is represented as Current Yield.

Current Yield Bond Formula And Calculator Excel Template

Bond Yield Calculator

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Yield To Call Ytc Bond Formula And Calculator Excel Template

Bond Yield Formula Calculator Example With Excel Template

Current Yield Bond Formula And Calculator Excel Template

Current Yield Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

Current Yield Formula Calculator Examples With Excel Template

Bond Pricing Formula How To Calculate Bond Price Examples

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Approximate Formula With Calculator

Bond Yield Calculator

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Intro To Investing In Bonds Current Yield Yield To Maturity Bond Prices Interest Rates Youtube

How To Calculate Bond Price In Excel